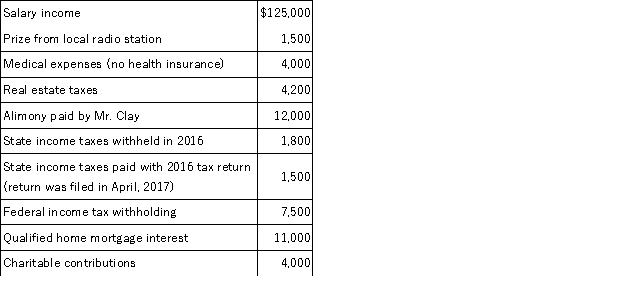

During all of 2016, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2016. Neither is blind, and both are under age 65. They reported the following tax-related information for the year:

A.What is the Clays' taxes payable or (refund due)? (ignore the alternative minimum tax)

B.What is the Clays' tentative minimum tax and alternative minimum tax?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Keith and Nicole are married filing joint

Q144: Demeter is a single taxpayer. Her AGI

Q145: Atlas earned $17,300 from his sole proprietorship

Q146: Sam is 30 years old. In 2016,

Q147: Akiko and Hitachi (married filing jointly for

Q148: In 2016, John (52 years old) files

Q152: Julien and Sarah are married, file a

Q152: Assume Georgianne underpaid her estimated tax liability

Q153: Wolfina's twins, Romulus and Remus, finished their

Q154: In 206, Shawn's AGI is $170,000. He

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents