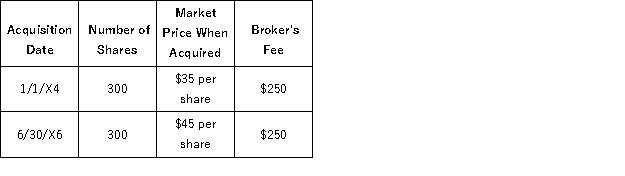

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase):

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Unused investment interest expense:

A)expires after the current

Q44: Investment interest expense does not include:

A)interest expense

Q45: Compare and contrast how interest income is

Q50: Investment expenses treated as miscellaneous itemized deductions

Q51: What is the correct order of the

Q52: Brandon and Jane Forte file a joint

Q53: On January 1,20X1,Fred purchased a corporate bond

Q74: A taxpayer's at-risk amount in an activity

Q76: What requirements must be satisfied before an

Q76: Assume that Joe has a marginal tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents