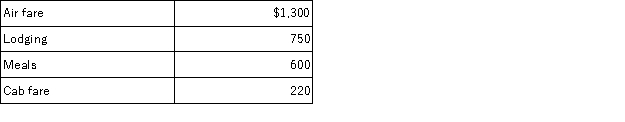

Fred's employer dispatched him on a business trip from the Dallas headquarters to New York this year. During the trip Fred incurred the following unreimbursed expenses:

What is the amount of Fred's deduction before the application of any AGI limitations?

A) $2,870.

B) $2,570.

C) $2,050.

D) $1,300.

E) $0 - the expenses cannot be deducted unless Fred is reimburseD.The meals are limited to 50% of the cost.

Correct Answer:

Verified

Q23: Which of the following taxes will not

Q28: This year Norma paid $1,200 of real

Q62: Glenn is an accountant who races stock

Q70: Which of the following is a true

Q72: Which of the following is a true

Q75: Which of the following is a true

Q76: Larry recorded the following donations this year:

$500

Q77: Which of the following is a true

Q78: Margaret Lindley paid $15,000 of interest on

Q79: Opal fell on the ice and injured

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents