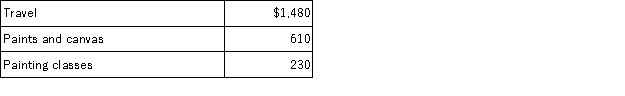

Homer is an executive who is paid a salary of $80,000. Homer also paints landscapes as a hobby. This year Homer expects to sell paintings for a total of $750 and incur the following expenses associated with his painting activities:

What is the effect of Homer's hobby on his taxable income? Assume his AGI does not reflect his painting activities and that he itemizes deductions but has no other miscellaneous itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Claire donated 200 publicly-traded shares of stock

Q64: Justin and Georgia file married jointly with

Q87: This year,Benjamin Hassell paid $20,000 of interest

Q94: Which of the following is a true

Q96: Kaylee is a self-employed investment counselor who

Q97: Which of the following is a true

Q100: Jenna (age 50) files single and reports

Q101: Bryan is 67 years old and lives

Q104: Colby is employed full time as a

Q108: Collin and Christine are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents