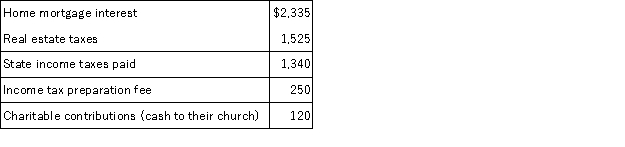

Misti purchased a residence this year. Misti is a single parent and lives with her 1-year old daughter. This year, Misti received a salary of $63,000 and made the following payments:

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Jon and Holly are married and live

Q63: Rochelle, a single taxpayer (age 47), has

Q102: Don's personal auto was damaged in a

Q104: Colby is employed full time as a

Q106: Clark is a registered nurse and full

Q107: Karin and Chad (ages 30 and 31,

Q110: This year Kelly bought a new auto

Q111: Toshiomi works as a sales representative and

Q112: Erika (age 67) was hospitalized with injuries

Q114: This year Darcy made the following charitable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents