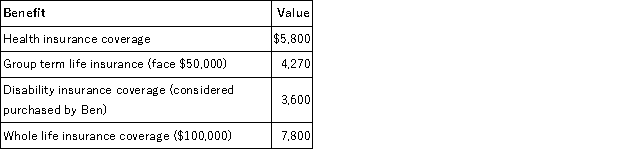

Ben's employer offers employees the following benefits. What amount must Ben include in his gross income?

A) $9,400

B) $11,070

C) $10,600

D) $7,000

E) Zero - none of the above benefits is included in gross income

Correct Answer:

Verified

Q93: Helen is a U.S. citizen and CPA,

Q94: This year, Barney and Betty sold their

Q97: Joyce's employer loaned her $50,000 this year

Q98: NeNe is an accountant and U.S. citizen,

Q99: Mike received the following interest payments this

Q100: Janine's employer loaned her $5,000 this year

Q114: Bernie is a former executive who is

Q119: Bart,a single taxpayer,has recently retired.This year,he received

Q120: Karl works at Moe's grocery.This year Karl

Q127: Hank is a U.S. citizen and is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents