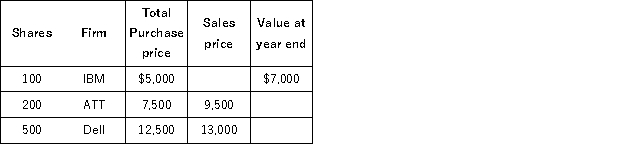

This year Ann has the following stock transactions. What amount is included in her gross income if Ann paid a $200 selling commission for each sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Aubrey and Justin divorced on June 30

Q111: Kathryn is employed by Acme and they

Q118: This year Kelsi received a $1,900 refund

Q121: Samantha was ill for four months this

Q124: This year Larry received the first payment

Q125: Juan works as a landscaper for local

Q131: Blake is a limited partner in Kling-On

Q152: Cyrus is a cash method taxpayer who

Q157: J.Z.(single taxpayer)is retired and received $10,000 of

Q172: Wendell is an executive with CFO Tires.At

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents