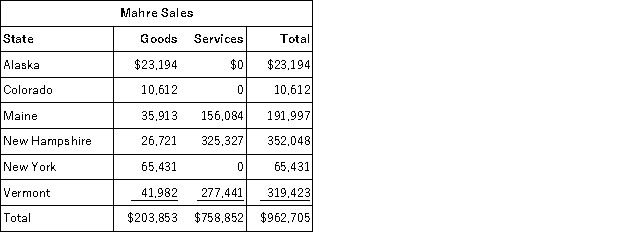

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out of state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:

Assume the following sales tax rates: Alaska (6.6 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

A) $0

B) $3,053

C) $13,267

D) $16,319

Correct Answer:

Verified

Q46: Historically, most states used an equally weighted

Q53: A gross receipts tax is subject to

Q54: Interest and dividends are allocated to the

Q58: The payroll factor includes payments to independent

Q59: The property factor is generally the average

Q64: Mahre, Incorporated, a New York corporation, runs

Q65: Which of the following isn't a criteria

Q66: PWD Incorporated is an Illinois corporation. It

Q68: Mighty Manny, Incorporated manufactures ice scrapers and

Q78: Public Law 86-272 protects solicitation from income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents