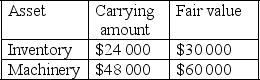

On 1 July 2016 Titans Ltd acquired a 25% share of Taylor Ltd.At that date,the following assets had carrying amounts different to their fair values in Taylor's books.

All inventory was sold to third parties by 30 June 2017.On 1 July 2016,the machinery had a remaining useful life of 3 years.

The tax rate is 30%.

The adjustment required to the investment in associate account at 30 June 2017 in relation to the above assets is:

A) $1750.

B) $2500.

C) $7000.

D) $10 000.

Correct Answer:

Verified

Q4: Kanga Limited acquired a 35% investment in

Q5: Which of the following is not one

Q8: The equity method of accounting for an

Q9: The accounting method applied to investments in

Q10: Where the investor is not a parent,

Q12: Adjustments made for the purpose of calculating

Q13: On 1 July 2016 Titans Ltd acquired

Q14: Where which of the following conditions exist,

Q14: Warriors Limited acquired a 20% share in

Q16: Voyager Ltd acquired a 40% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents