Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 20X5.On the same day,Frangipani Limited acquired a 60% ownership interest in Gardener Limited.The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7:

On 1 July 20X5 Gardener sold an item of plant to Jacaranda for a profit of $25 000.The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 20X5,Gardener paid a dividend of $100 000 from profits earned prior to 30 June 20X5.

Jacaranda lent $500 000 to Gardener on 1 January 20X6.Interest charged on the loan for the year ended 30 June 20X6 was $20 000 and for the year ended 30 June 20X7 was $40 000.

On 31 May 20X6 Frangipani sold inventory to Gardener for $15 000.Profit earned on the sale was $1500.Gardener sold the inventory to external parties on 1 August 20X6.

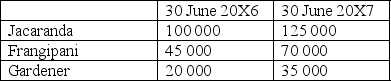

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The effect of the dividend paid by Gardener to Frangipani on the NCI of Gardener for the year ended 30 June 20X6 is:

A) nil.

B) $15 000.

C) $40 000.

D) $55 000.

Correct Answer:

Verified

Q1: In a situation where a parent acquires

Q4: Kerri Limited has a 60% ownership interest

Q15: Nambour Limited has a direct ownership interest

Q16: Waratah Ltd acquired a 60% ownership

Q18: An ownership structure in which Orange Limited

Q19: When calculating the direct non-controlling interest share

Q20: Consider the following economic entity structure:

Q23: The accounting for intragroup transactions is not

Q40: Realty Group had the following debits in

Q43: The indirect NCI is entitled to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents