During the year ended 30 June 2017,a parent entity rents a warehouse from a subsidiary entity for $200 000.The company tax rate is 30%.Which of the following is the consolidation adjustment entry needed at reporting date to eliminate the transaction?

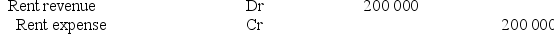

A)

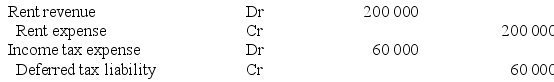

B)

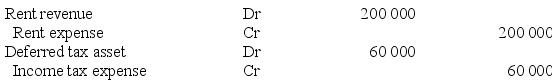

C)

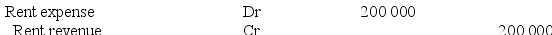

D)

Correct Answer:

Verified

Q27: When a depreciable non-current asset is sold

Q29: Where an intragroup sale of an asset

Q30: If an interim dividend is paid by

Q35: The effect of an intragroup sale of

Q36: Where an intragroup sale of an asset

Q37: The effect of an intragroup sale of

Q38: Which of the following items is an

Q38: Where there is an intragroup sale of

Q39: If an entity sells a non-current asset

Q40: A consolidation worksheet adjustment to eliminate the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents