On 30 June 2014,Walters Limited had an item of plant with an original cost of $140 000 and accumulated depreciation of $56 000.At this date,the fair value of the plant was $100 000 and Walters Limited revalued the plant.Assuming a tax rate of 30%,the tax effect of the revaluation would be recorded as which of the following?

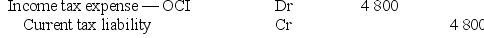

A)

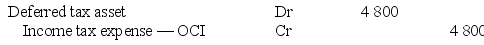

B)

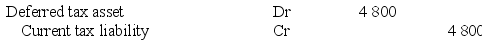

C)

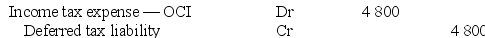

D)

Correct Answer:

Verified

Q21: Costs of removal or dismantling an asset

Q22: When using the revaluation model:

A) ongoing record

Q23: Under AASB 116 Property, Plant and Equipment,

Q27: Expenditure designed to improve the quality of

Q28: Costs of testing whether an asset is

Q29: Depreciation is an accounting process which involves

Q31: Costs of training staff in the use

Q33: Depreciation is not recognised if an asset's

Q35: Where an entity acquires a bundle of

Q48: The residual value of a non-current asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents