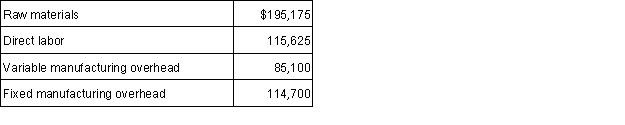

Great Bay Co. manufactures cordless telephones. During 2016, total costs associated with manufacturing 18,500 of the AB-2000 model (introduced this year) were as follows:

(a.) Calculate the cost per phone under both direct (or variable) costing and absorption costing.(b.) If 2,800 of these phones were in finished goods inventory at the end of 2016, by how much and in what direction (higher or lower) would 2016 operating income be different under direct (or variable) costing than under absorption costing?

(c.) Express the phone cost in a cost formula. What does this formula suggest the total cost of making an additional 1,600 phones would be?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Which of the following items would be

Q52: The following table summarizes the beginning and

Q55: Eberlin Boats estimates the following for 2016:

During

Q55: The following information is from ABC Company's

Q56: Envision Company uses activity-based costing (ABC) for

Q57: AAA Plumbing Co. incurred the following costs

Q59: Erca, Inc. produces automobile bumpers. Overhead is

Q60: Cost management initiatives along an organization's value

Q61: Baja Industries has recently switched its method

Q62: The following are beginning and ending inventories

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents