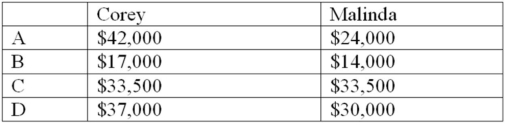

Corey and Malinda started a partnership on January 1,2012.Corey invested $25,000 in the business,and Malinda invested $20,000.The partnership agreement stated that profits would be divided between the partners based on their initial investment in the partnership.The business's net income for 2010 was $36,000.During the year,Corey withdrew $8,000,and Malinda withdrew $6,000.The balances in the partners' accounts at the end of 2012 were

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q2: Which form of business organization is established

Q7: Which of the following entities would have

Q9: The term "Retained Earnings" is best explained

Q9: On February 2,2012,Barker's Pool Supply Corporation issued

Q10: The term "double taxation" refers to which

Q11: On January 12,2012,the Picard Corporation issued 750

Q14: Which of the following terms designates the

Q17: Which of the following terms designates the

Q18: Which of the following statements historically described

Q19: Which of the following statements about types

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents