Allen Corporation was organized on July 15,2012.It was authorized to issue 150,000 shares of $25 par value common stock and 50,000 shares of 6% cumulative preferred stock.The preferred stock had a stated value of $50 per share.The following stock transactions relate to Allen Corporation.

Issued 55,000 shares of common stock for $33 per share.

Issued 2,750 shares of the class A preferred stock for $62 per share.

Issued 27,500 shares of common stock for $35 per share.

Required:

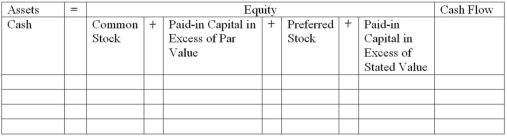

a)Indicate the effect of each of these transactions on Allen's financial statements.Include dollar amounts in the model,below.After recording the three transactions,calculate column totals.

b)After these transactions have been recorded,what is the total amount of stockholders' equity?

c)After these transactions have been recorded,how many shares of common stock are outstanding?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: On what date do dividends become a

Q34: Show the effect of a stock dividend

Q36: Discuss possible reasons why a corporation may

Q111: For 2012,the Hilary Corporation had beginning and

Q116: Indicate how each of the following transactions

Q117: Fredericksburg Corporation had issued and outstanding 150,000

Q128: The Harlan-Wells Company was started on January

Q129: The Garza Company was started on January

Q135: Discuss a few common reasons for decreases

Q147: Describe how the following transactions affect the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents