Austin Corporation was authorized to issue 100,000 shares of $10 par common stock.During 2012 Austin issued 30,000 shares at a market price of $15 per share.On December 1,2012,Austin declared a cash dividend of $2 per share payable on December 30 to stockholders of record as of December 15.

Required:

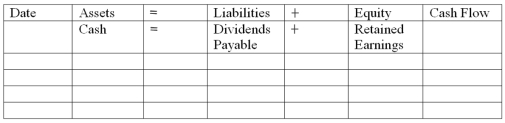

a)Indicate effect on financial statements on the date of declaration,date of record,and date of payment of the cash dividends.Use the model below.  b)What kind of transaction is the declaration of a cash dividend?

b)What kind of transaction is the declaration of a cash dividend?

c)What kind of transaction is the payment of a cash dividend?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Which type of stock,common or preferred,must all

Q101: Houston Corporation has the following stock outstanding:

Q105: Liu Corporation's balance sheet reflected the following

Q107: The corporate charter of Llano Corporation authorizes

Q117: What are the characteristics of preferred stock?

Q123: Explain the significance of a high price-earnings

Q127: Discuss a reason why a corporation might

Q131: An appropriation of retained earnings places a

Q138: On January 1, 2012, the organizers of

Q149: Anstendig Corp. has 250,000 shares of common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents