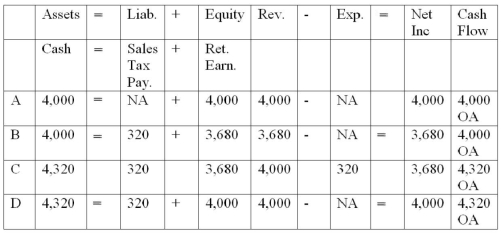

Garza Corporation sold merchandise to a customer for $4,000 subject to sales tax at 8%.The effects on the financial statements were:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q2: Payment of previously-accrued interest on a note

Q5: Providing repair services to a customer under

Q6: In accounting for a contingent liability, if

Q10: In accounting for a contingent liability, if

Q10: On December 31,2010,Malcolm Corporation accrued interest on

Q12: Accruing product warranty expense at the end

Q12: Nevada Company remitted to the state $1,800

Q13: On November 1,2012,Fain Corporation paid principal and

Q14: Chicago Company sold merchandise to a customer

Q15: What is the going concern assumption?

A) Assumes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents