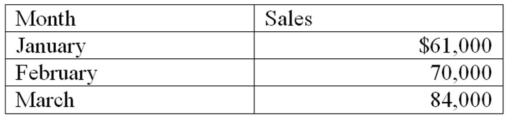

Rosen Hardware Company recorded the following sales for the first quarter of 2012:  These amounts do not include sales taxes.The company is in a state with a sales tax rate of 6 percent.

These amounts do not include sales taxes.The company is in a state with a sales tax rate of 6 percent.

Required:

a)Calculate the amount of sales tax that the company collected from its customers for each month.

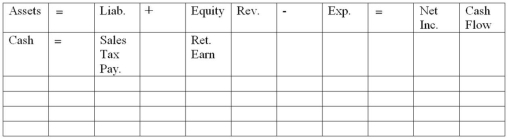

b)For each month,indicate the effect of the sales and collection of sales tax on the statements model,below.Show dollar amounts of increases and decreases; enter NA if an item is not affected.In the cash flows column,designate cash flows as operating activities (OA),investing activities (IA).or financing activities (FA).

c)On March 31,Rosen Hardware remitted to the state the total amount of sales tax for the quarter.Indicate in the statements model the effect of this transaction.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: In 2012,the balance sheet of Worth Company

Q126: Rominger Company borrowed $10,000 from the bank

Q128: The Candy Junction operates two candy stores.Sales

Q129: What is a bond discount? What is

Q131: Roskos Corporation issued to Ewold Bank a

Q132: Saam Company borrowed $40,000 from the bank

Q133: San Jose Company issued 5-year $200,000 face

Q134: What is solvency? How could you measure

Q146: Rugh Company has been sued by two

Q147: Osgood Company estimated that its warranty expense

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents