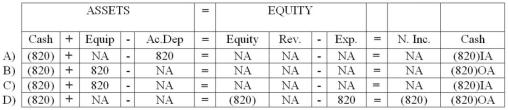

On January 1,2012,Snyder Company spent $820 on an asset (a machine) to improve its quality.The machine had been purchased on January 1,2010 for $4,200 and had an estimated salvage value of $600 and a useful life of five years.Which of the following correctly shows the effects of the 2012 expenditure on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q17: On March 1, Zane Company purchased a

Q21: If Desmet Company had used the double-declining

Q22: An asset with a book value of

Q23: Flynn Company experienced an accounting event that

Q24: On September 10,2012,Barden Company sold a piece

Q26: Rouse Company owned an asset that had

Q27: Laurens Company purchased equipment that cost $10,000

Q28: At the beginning of 2013,Reno revised the

Q30: Assume that Desmet Company sold the office

Q38: Which of the following statements is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents