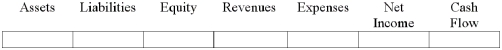

An asset purchased for $14,000 that had a $4,000 salvage and a 4-year life was depreciated using straight line depreciation for two years.At the beginning of the third year,the total useful life of the asset is revised to 5 years.Show how the revised depreciation expense will affect the financial statements.

Correct Answer:

Verified

Q5: Expenditures that extend the useful life of

Q81: A trademark has a total legal and

Q83: Hamilton Mining Company recognized $2,000,000 of depletion

Q85: The Borger Company purchased an asset for

Q86: Baird Enterprises purchased equipment on account on

Q88: Graettinger Manufacturing Company spent $4,000 to extend

Q89: The XYZ Company purchased the ABC Company

Q89: The choice of depreciation methods for long-term

Q90: Bowen Company amortized $3,000 of patent cost.

Q157: An impairment of an intangible asset reduces

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents