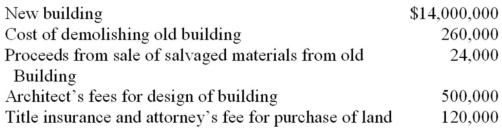

On May 4,2012,Regan Company purchased a tract of land as a factory site for $3,000,000.An existing building on the property was demolished,and construction was begun on a new factory building in July 2012 and completed December 15,2012.Cost data are shown below.  Required:

Required:

Compute the amounts that should be recorded as the cost of a)the land and b)the new factory building.

Correct Answer:

Verified

Q25: Explain how a choice of depreciation methods

Q26: Explain the meaning of "impairment" as used

Q38: State the reason that goodwill is not

Q40: Explain the meaning of the terms "tangible"

Q131: Clampett Corporation paid cash to acquire land

Q132: In 2012,Albert Mining Co.purchased a coal mine

Q134: How does the treatment of goodwill differ

Q136: Schultz Corporation purchased equipment on January 2,2012

Q137: In January 2012,Rogers Co.purchased a machine that

Q141: In 2012,Harold Corporation Co.acquired a patent from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents