Teague Company purchased a new machine on January 1,2012,at a cost of $150,000.The machine is expected to have an eight-year life and a $15,000 salvage value.The machine is expected to produce 675,000 finished products during its eight-year life.Smith produced 70,000 units in 2012 and 110,000 units during 2013.

Required:

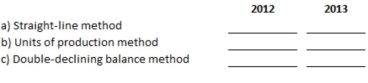

Determine the amount of depreciation expense to be recorded on the machine for the years 2012 and 2013 under each of the following methods:

Correct Answer:

Verified

Q24: For what types of assets is the

Q122: On January 1,2012,Studer Corporation paid $6,000 for

Q123: Muller Corporation purchased a new truck on

Q127: Smith Corporation purchased land and a building

Q128: On January 1,2012,St.John Corp.purchased a new truck

Q129: On January 1,2012,Stassi Corporation purchased equipment for

Q131: Clampett Corporation paid cash to acquire land

Q132: In 2012,Albert Mining Co.purchased a coal mine

Q136: On January 2, 2012, Brimm Corporation purchased

Q138: Describe what is meant by the term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents