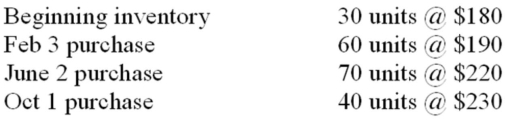

Stewart Company sold 180 units @ $320 each on October 31,2012.Cash selling and administrative expenses were $15,000.The following information is also available:  The company's income tax rate is 40%.

The company's income tax rate is 40%.

Required:

a)Determine the amount of cost of goods sold using:

FIFO

LIFO

Weighted Average

b)Determine the amount of ending inventory using:

FIFO

LIFO

Weighted Average

c)Determine the company's net income (after income taxes)using:

FIFO

LIFO

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: How does the collection of an account

Q103: Explain how a company would calculate the

Q113: What is an aging of accounts receivable,

Q121: If Schulze Company is using LIFO, how

Q126: In an inflationary period, which cost flow

Q141: Porter Company experienced the following events during

Q144: Riley Corporation accepted credit cards for $107,200

Q145: In the first year of operations,2012,Ringsted Repair

Q146: Warden Company has the following account balances

Q148: During November 2012,Cooper Company sold 120 units

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents