Ruthven Company had the following transactions for 2012,the first year of operations:

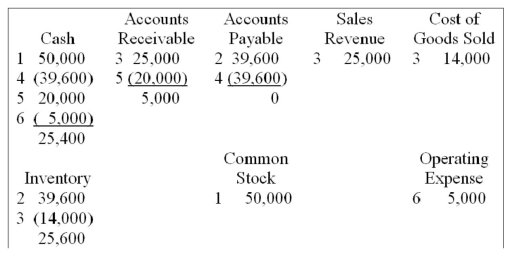

1)Issued common stock for $50,000 cash.

2)Purchased merchandise on account,$40,000,terms 1/10,n/30.

3)Sold merchandise on account for $25,000.The inventory sold had cost $14,000.

4)Paid for the merchandise purchased within the discount period.

5)Collected $20,000 on the merchandise sold on account.

6)Paid operating expense of $5,000.

Required:

a)What are total assets at the end of 2012?

b)What is the balance of the cash account at the end of 2012?

c)What is gross margin for 2012?

d)What is net income for 2012?

e)What are total liabilities at the end of 2012?

f)What is total equity at the end of 2012?

g)What is total retained earnings at the end of 2012?

h)What was the amount of cash flows from operating activities?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: Discuss the major differences between a perpetual

Q126: Explain the computation of and the meaning

Q132: The following events pertain to Burlington Supply

Q132: On which financial statement(s) does the Cost

Q134: Howard Company's first year in operation was

Q137: Merrick Company began operations in 2012 by

Q137: Indicate how accounting for lost and stolen

Q139: When using the perpetual inventory method, when

Q139: Rowdy Company's first year in operation was

Q140: What annual interest rate is implied by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents