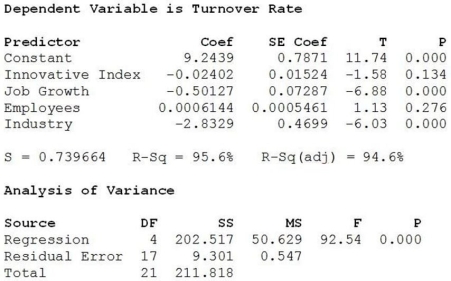

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.  a. Write out the estimated regression equation.

a. Write out the estimated regression equation.

b. Are all of the independent variables significant in this regression equation (using α = 0.05)? Explain.

c. Interpret the coefficient of the Industry.

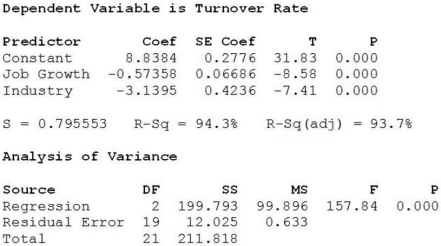

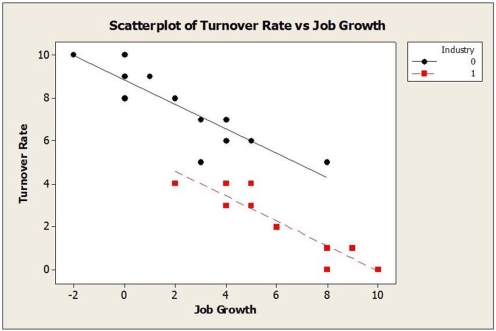

d. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.  e. Based on the scatterplot below, is it appropriate to use Industry as an indicator variable in this regression model? Explain.

e. Based on the scatterplot below, is it appropriate to use Industry as an indicator variable in this regression model? Explain.  f. Using the better model, predict turnover rate for a firm in the financial services sector with 1000 employees, an innovative index of 50 and 2% job growth rate.

f. Using the better model, predict turnover rate for a firm in the financial services sector with 1000 employees, an innovative index of 50 and 2% job growth rate.

Correct Answer:

Verified

Turnover R...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Consider the following to answer the question(s)

Q2: A sample of 30 companies was randomly

Q3: Consider the following to answer the question(s)

Q5: Consider the following to answer the question(s)

Q6: Which of the following statements describing the

Q7: Using this model, the predicted turnover rate

Q8: Consider the following to answer the question(s)

Q9: Which of the following statements does not

Q10: Consider the following to answer the question(s)

Q11: Trying to estimate possible collinearity in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents