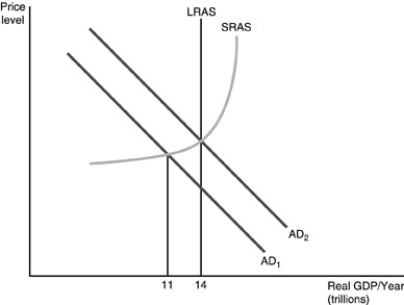

-Refer to the above figure.The government has just engaged in expansionary fiscal policy shifting the aggregate demand curve from  to

to  .Interest rates have started to rise.Which of the following statements is true in the short run?

.Interest rates have started to rise.Which of the following statements is true in the short run?

A) Real GDP will be $14 trillion since the effect of government spending is not influenced by interest rates.

B) Real GDP will fall back to $11 trillion since the effect that increased government spending has on real GDP is short lived.

C) Real GDP will go beyond $14 trillion as businesses and consumers react to the increase in interest rates.

D) Real GDP will end up somewhere between $11 and $14 trillion as businesses and consumers reduce their spending in response to the increase in interest rates.

Correct Answer:

Verified

Q83: The government wants to increase its spending

Q90: According to supply-side economics, changes in marginal

Q90: The crowding-out effect is

A)due to the upward

Q95: The concept that increased government spending will

Q98: The tendency for expansionary fiscal policy to

Q104: "Expansionary fiscal policy is always 100 percent

Q108: The proposition that decreases in taxes that

Q112: A decrease in taxes will have no

Q119: Expansionary fiscal policy falls short of its

Q122: The Laffer curve

A) initially slopes upward as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents