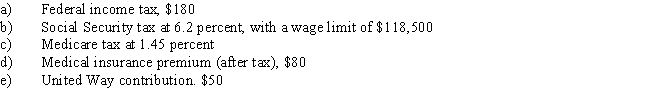

Sarah, an employee of Allen Company, worked 45 hours during the week of August 29. Her rate of pay is $18.50 per hour, and she receives time-and-a-half for work in excess of 40 hours per week. Sarah is single and claims zero allowances on her W-4 form. Her YTD (year-to-date) earnings before this pay period are $34,730 with wages subject to the following deductions:

Instructions:

1.Compute Sarah's regular pay, gross pay, and net pay.

2.Record this pay information in Sarah's employee earnings record, using check number 152.

Correct Answer:

Verified

?

2)

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Match the terms below with the correct

Q84: The journal entry for recording the payroll

Q85: Explain the similarities and differences in the

Q86: Match the terms below with the correct

Q87: Employees' individual earnings records are not needed

Q89: Match the terms below with the correct

Q90: Match the terms below with the correct

Q91: Compare and contrast an employee and an

Q92: Match the terms below with the correct

Q93: An employee's individual earnings record is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents