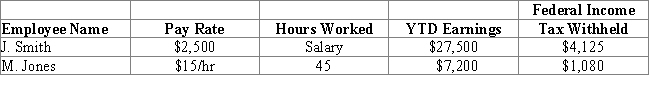

Colin Street Body Shop has the following information for the pay period ending March 31st: Assume the Following:

FICA-SS Tax Rate is 6.2%

FICA-Medicare Tax Rate is 1.45%

FUTA Tax Rate is 0.6% on the first $7,000 of wages paid

SUTA Tax Rate is 5% on the first $9,000 of wages paid

From the information provided above, what would be the amount of Wage Expense recorded?

A) $712.50

B) $2,500.00

C) $3,175.00

D) $3,212.50

Correct Answer:

Verified

Q33: If a tax payment is made, what

Q34: Which of the following statement is true?

A)

Q35: Which of the following frauds refers to

Q36: This form is also called the Transmittal

Q37: SUTA taxes are normally paid:

A) Annually

B) Quarterly

C)

Q39: The number assigned to employers by the

Q40: Which of the following forms is an

Q41: Once the employee's income reaches the limit

Q42: The W-3 shows all of the following

Q43: The employer becomes liable for payroll tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents