Hardy Company has the following balances in its general ledger as of September 1 of this year:

1.

FICA Taxes Payable (liability for August), $1,150.00 (employee and employer).

2.

Employees' Federal Income Tax Payable (liability for August), $908.00.

3.

Federal Unemployment Tax Payable (liability for July and August), $215.00.

4.

State Unemployment Tax Payable (liability for July and August), $1,262.75.

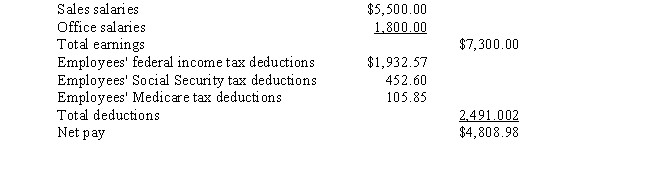

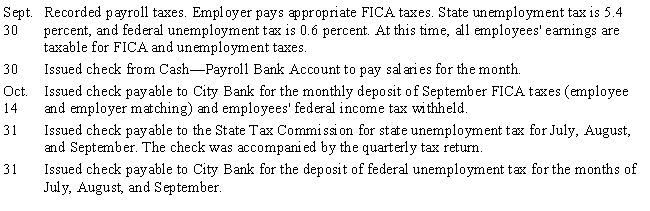

The company completed the following transactions involving the payroll during September and October:

?

?

??

??

?

?

?

?

Instructions:

Record the transactions in the general journal.

Correct Answer:

Verified

Q82: Match the terms that follow with the

Q83: Explain the difference between Form W-2 and

Q84: Compare and contrast payroll Forms 940 and

Q85: Mark Construction Company received and paid a

Q86: Match the terms that follow with the

Q88: Match the terms that follow with the

Q89: Match the terms that follow with the

Q90: Match the terms that follow with the

Q91: Match the terms that follow with the

Q92: Match the terms that follow with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents