Jane's Animal Haven uses the general journal to record its charge sales invoices instead of a sales journal. The sales tax rate is 4.5 percent on retail item(s).

Instructions:

1.

Record the June 1 balances, if any, in the general ledger as given: Accounts Receivable 113 controlling account, $1,326; Sales Tax Payable 214, Sales 411, $26,852, Sales Returns and Allowances 412. Write "Balance" in the Item column and place a check mark in the Post. Ref. column.

2.

Open the following accounts in the accounts receivable ledger and record the balances, if any, as of June 1: J. Green; G. Haas, $656; S. Soudah; L. Wold. For the account having a balance, write "Balance" in the Item column and place a check mark in the Post. Ref. column.

3.

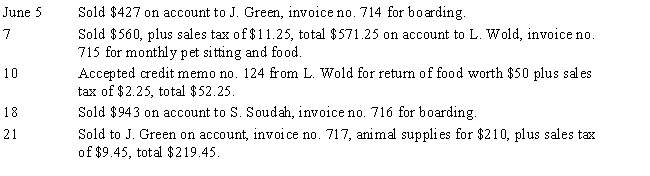

Record the below transactions in the general journal for the total amount of the charge sales invoices.

4.

Post the amounts from the general journal to the general ledger and accounts receivable ledger. Write the invoice number of each sales invoice in the Post. Ref. column to indicate that the amounts have been posted.

5.

Prepare a schedule of accounts receivable.

?

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: What is the difference between a periodic

Q87: Freight charges on store equipment purchased FOB

Q88: Transactions for purchases returns and allowances affecting

Q89: Black Corporation had the following transactions take

Q90: The return of goods for credit would

Q92: If the perpetual inventory system is used,

Q93: Match the terms below with the correct

Q94: What are the four most commonly used

Q95: The Accounts Payable account in the general

Q96: With FOB shipping point, the seller maintains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents