The price of a bond with no expiration date is originally $5,000 and it pays an annual interest payment of $500. If the price of the bond falls to $3,000, then the effective interest rate yield to a new buyer of the bond is:

A) 14.4 percent.

B) 16.6 percent.

C) 11.0 percent.

D) 9.0 percent.

McConnell - Chapter 13 #70

Correct Answer:

Verified

Q27: The price of a bond having no

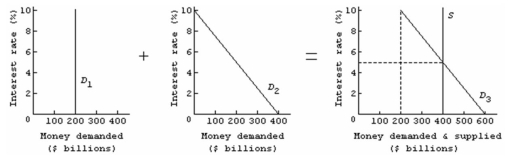

Q67: Q83: If there is an increase in nominal Q93: The following are simplified consolidated balance sheets Q106: The Bank of Canada: Q108: An important routine function of the Bank Q110: In the consolidated balance sheet of the Q112: In the consolidated balance sheet of the Q117: Suppose the demand for money and the Q228: A bond with no expiration has an![]()

A)acts as a fiscal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents