Assume that the desired reserve ratio for the chartered banks is 25 percent. If Bank of Canada buys $3 billion in government securities from chartered banks we can say that, as a result of this transaction, the lending ability of the chartered banking system will:

A) decrease by $9 billion.

B) increase by $9 billion.

C) increase by $15 billion.

D) increase by $12 billion.

McConnell - Chapter 13 #98

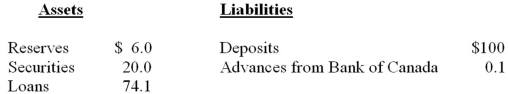

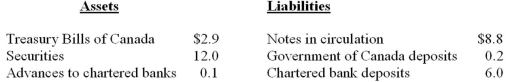

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada. Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question. Assume a desired reserve ratio of 5 percent for the chartered banks. All figures are in billions of dollars.

CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA

Correct Answer:

Verified

Q85: The following are simplified consolidated balance sheets

Q102: If the monetary authorities want to reduce

Q111: Notes in circulation are:

A)an asset as viewed

Q114: The following is a simplified consolidated balance

Q120: The reserves of the chartered banks are

Q124: If the Bank of Canada buys government

Q126: When the Bank of Canada buys bonds

Q143: The bank rate is the rate of

Q148: The major purpose of the Bank of

Q160: If the chartered banking system borrows from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents