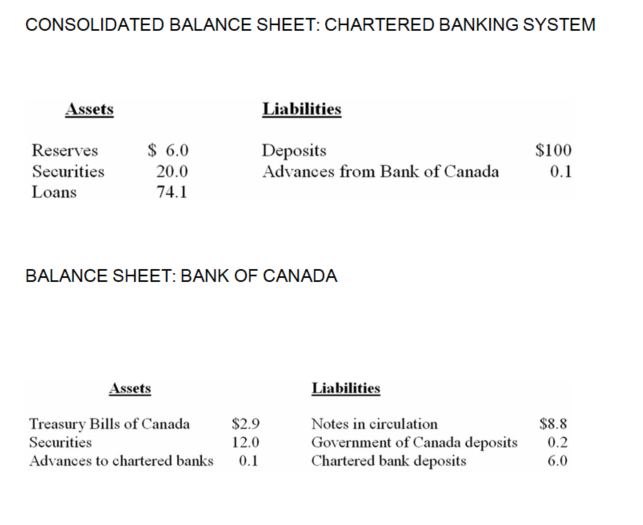

The following is a simplified consolidated balance sheet for the chartered banking system and the Bank of Canada. Assume a desired reserve ratio of 5 percent for the chartered banks. All figures are in billions of dollars.

-Refer to the above information,suppose the Bank of Canada sells $2 in securities directly to the chartered banks.As a result of this transaction,the supply of money:

A) will directly increase by $2 and the money-creating potential of the chartered banking system will increase by $38.

B) will directly decrease by $2 and the money-creating potential of the chartered banking system will decrease by $40.

C) is not directly affected,but the money-creating potential of the chartered banking system will decrease by $40.

D) will decrease by $2,but the money-creating potential of the chartered banking system will not be affected.

Correct Answer:

Verified

Q112: Assume that the desired reserve ratio is

Q122: Which of the following is correct? When

Q128: Which of the following will not happen

Q132: Assume that a single chartered bank has

Q134: Which of the following statements is not

Q142: The interest rate at which the Bank

Q151: When a chartered bank borrows from the

Q155: The overnight lending rate is the rate

Q159: The bank rate is the rate of

Q160: If the chartered banking system borrows from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents