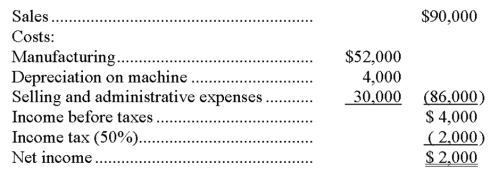

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and be depreciated over a three-year period with no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. A projected income statement for each year of the asset's life appears below. What is the accounting rate of return for this machine?

A) 33.3%.

B) 16.7%.

C) 50.0%.

D) 8.3%.

E) 4%.

Correct Answer:

Verified

Q61: Beyer Corporation is considering buying a machine

Q62: A company buys a machine for $60,000

Q63: Which of the following cash flows is

Q68: The hurdle rate is often set at:

A)

Q69: After-tax net income divided by the annual

Q70: Which one of the following methods considers

Q71: The time expected to pass before the

Q76: A company is considering the purchase of

Q76: The following present value factors are provided

Q78: A company is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents