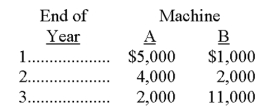

Saxon Manufacturing is considering purchasing two machines. Each machine costs $9,000 and will produce cash flows as follows:  Saxon Manufacturing uses the net present value method to make the decision, and it requires a 15% annual return on its investments. The present value factors of 1 at 15% are: 1 year, 0.8696; 2 years, 0.7561; 3 years, 0.6575. Which machine should Saxon purchase?

Saxon Manufacturing uses the net present value method to make the decision, and it requires a 15% annual return on its investments. The present value factors of 1 at 15% are: 1 year, 0.8696; 2 years, 0.7561; 3 years, 0.6575. Which machine should Saxon purchase?

A) Only Machine A is acceptable.

B) Only Machine B is acceptable.

C) Both machines are acceptable, but A should be selected because it has the greater net present value.

D) Both machines are acceptable, but B should be selected because it has the greater net present value.

E) Neither machine is acceptablE.

Correct Answer:

Verified

Q83: A new manufacturing machine is expected to

Q85: Axle Company can produce a product that

Q95: Sherman Company can sell all of its

Q96: A company is considering the purchase of

Q100: Edgar Company is considering the purchase of

Q101: A company puts four products through a

Q102: Jorgensen Department Store has three departments: Clothing,

Q104: Bower Co. is reviewing a capital investment

Q129: Briefly describe the time value of money.

Q160: How does the calculation of break-even time

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents