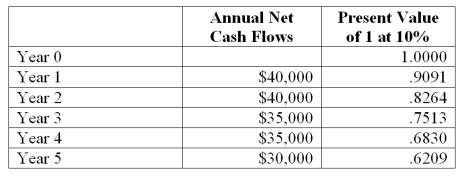

Eagle Company is considering the purchase of an asset for $100,000. It is expected to produce the following net cash flows. The cash flows occur evenly throughout each year. Compute the break-even time (BET) period for this investment. (Round to two decimal places.)

A) 2.85 years.

B) 2.57 years.

C) 3.17 years.

D) 2.98 years.

E) 3.62 years.

Correct Answer:

Verified

Q82: Barnes manufactures a specialty food product that

Q84: A company is considering a 5-year project.

Q84: A company can buy a machine that

Q87: Edgar Company is considering the purchase of

Q88: A new manufacturing machine is expected to

Q91: A machine costs $180,000 and is expected

Q92: Eagle Company is considering the purchase of

Q95: Sherman Company can sell all of its

Q97: The rate that yields a net present

Q127: What is capital budgeting? Why are capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents