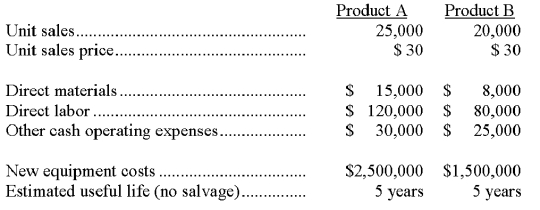

A company is trying to decide which of two new product lines to introduce in the coming year. The company requires a 12% return on investment. The predicted revenue and cost data for each product line follows:  The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

Correct Answer:

Verified

Q125: Sherman Company can sell all of product

Q135: A company produces two boat models, Montauk

Q136: A company is considering a proposal to

Q137: A company is considering a 5-year project.

Q140: Casco Company is considering the purchase of

Q142: The minimum acceptable rate of return on

Q145: A capital budgeting method that considers how

Q148: The _ is computed by dividing a

Q162: A(n) _ is the potential benefit lost

Q188: The _ is computed by discounting the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents