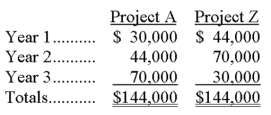

A company is considering two alternative investment opportunities, each of which requires an initial cash outlay of $110,000. The expected net cash flows from the two projects follow:  Required:

Required:

(1) Based on a comparison of their net present values, and assuming the same discount rate (greater than zero) is required for both projects, which project is the better investment? (Check one answer.)

________________ Project A

________________ Project Z

________________ The projects are equally desirable

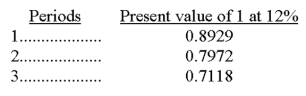

(2) Use the table values below to find the net present value of the cash flows associated with Project A, discounted at 12%:

Correct Answer:

Verified

Q125: Sherman Company can sell all of product

Q129: A company has a decision to make

Q131: A company is considering two projects, Project

Q134: Fields Company currently manufactures one of its

Q135: A company produces two boat models, Montauk

Q136: A company is considering a proposal to

Q137: A company is considering a 5-year project.

Q142: The minimum acceptable rate of return on

Q171: _ is the process of analyzing alternative

Q174: Relevant costs are also known as _.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents