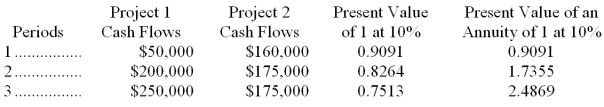

Braybar Company is deciding between two projects. Each project requires an initial investment of $350,000. The projected net cash flows for the two projects are listed below. The revenue is to be received at the end of each year. Braybar requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below. Use net present value to determine which project should be pursued and explain why.

Correct Answer:

Verified

Q122: A company is considering the purchase of

Q123: A company inadvertently produced 3,000 defective products.

Q125: A company is trying to decide which

Q129: A company has a decision to make

Q131: A company is considering two projects, Project

Q134: Fields Company currently manufactures one of its

Q135: A company can buy a machine that

Q137: A company is evaluating the purchase of

Q171: _ is the process of analyzing alternative

Q174: Relevant costs are also known as _.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents