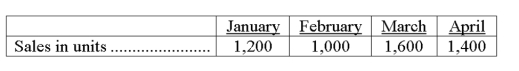

Tappet Corporation is preparing its master budget for the quarter ending March 31. It sells a single product for $25 a unit. Budgeted sales are 40% cash and 60% on credit. All credit sales are collected in the month following the sales. Budgeted sales for the next four months follow:  At December 31, the balance in accounts receivable is $10,000, which represents the uncollected portion of December sales. The company desires merchandise inventory equal to 30% of the next month's sales in units. The December 31 balance of merchandise inventory is 340 units, and inventory cost is $10 per unit. Forty percent of the purchases are paid in the month of purchase and 60% are paid in the following month. At December 31, the balance of Accounts Payable is $8,000, which represents the unpaid portion of December's purchases. Operating expenses are paid in the month incurred and consist of:

At December 31, the balance in accounts receivable is $10,000, which represents the uncollected portion of December sales. The company desires merchandise inventory equal to 30% of the next month's sales in units. The December 31 balance of merchandise inventory is 340 units, and inventory cost is $10 per unit. Forty percent of the purchases are paid in the month of purchase and 60% are paid in the following month. At December 31, the balance of Accounts Payable is $8,000, which represents the unpaid portion of December's purchases. Operating expenses are paid in the month incurred and consist of:

Sales commissions (10% of sales)

Freight (2% of sales)

Office salaries ($2,400 per month)

Rent ($4,800 per month)

Depreciation expense is $4,000 per month. The income tax rate is 40%, and income taxes will be paid on April 1. A minimum cash balance of $10,000 is required, and the cash balance at December 31 is $10,200. Loans are obtained at the end of a month in which a cash shortage occurs. Interest is 1% per month, based on the beginning of the month loan balance, and must be paid each month. If an excess of cash exists, loan repayments are made at the end of the month. At December 31, the loan balance is $0. Prepare a master budget (round all dollar amounts to the nearest whole dollar) for each of the months of January, February, and March that includes the:

Sales budget

Table of cash receipts

Merchandise purchases budget

Table of cash disbursements for merchandise purchases

Table of cash disbursements for selling and administrative expenses

Cash budget, including information on the loan balance

Budgeted income statement

Correct Answer:

Verified

Q128: What is a manufacturing budget?

Q137: In preparing a budget for the last

Q138: Nano, Inc. is preparing its budget for

Q141: David, Inc., is preparing its master budget

Q156: Miles Company is preparing a cash budget

Q157: The Lamb Company budgeted sales for January,

Q167: What is a sales budget? How is

Q179: What is activity-based budgeting?

Q185: A sporting goods store budgeted August purchases

Q188: What is a capital expenditures budget?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents