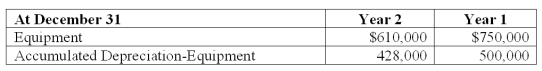

Sebring Company reports depreciation expense of $40,000 for Year 2. Also, equipment costing $140,000 was sold for a $10,000 loss in Year 2. The following selected information is available for Sebring Company from its comparative balance sheet. Compute the cash received from the sale of the equipment.

A) $62,000.

B) $38,000.

C) $28,000.

D) $18,000.

E) $58,000.

Correct Answer:

Verified

Q103: Woodlawn Company is preparing the company's statement

Q110: Trenton reports net income of $230,000 for

Q126: Castine reports net income of $305,000 for

Q130: A company had average total assets of

Q135: Sebring Company reports depreciation expense of $40,000

Q137: Weston is preparing the company's statement of

Q141: Aster Company's 2011 income statement and changes

Q181: What are the five usual steps involved

Q195: Define and discuss the differences between operating,

Q200: Define the cash flow on total assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents