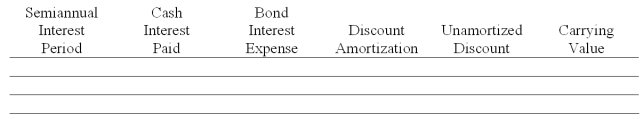

A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295, to yield the buyers a 12% return. The company uses the effective interest amortization method. Interest is paid semiannually each June 30 and December 31.

(1) Prepare an amortization table for the first two payment periods using the format shown below:  (2) Prepare the journal entry to record the first semiannual interest payment.

(2) Prepare the journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

Q160: Walker Corporation issued 14%,5-year bonds with a

Q163: On August 1,a company issues bonds with

Q165: On January 1, a company issues bonds

Q165: A company calls $150,000 par value of

Q166: On January 1, a company issues bonds

Q168: A company issued 10%, 5-year bonds with

Q184: A company issued 10-year, 9% bonds with

Q194: On January 1, a company issued 10%,

Q206: On January 1, Year 1 a company

Q210: A company has 10%, 20-year bonds outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents