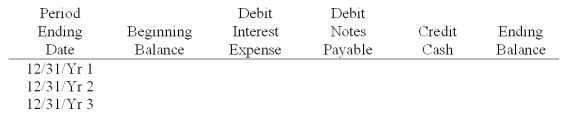

A company purchased two new delivery vans for a total of $250,000 on January 1, Year 1. The company paid $40,000 cash and signed a $210,000, 3-year, 8% note for the remaining balance. The note is to be paid in three annual end-of-year payments of $81,487 each, with the first payment on December 31, Year 1. Each payment includes interest on the unpaid balance plus principal.

(1) Prepare a note amortization table using the format below:  (2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

(2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

Correct Answer:

Verified

Q108: What are the methods that a company

Q109: Describe the recording procedures for the issuance,

Q124: A company enters into an agreement to

Q156: A company issued 10-year,9% bonds with a

Q160: Walker Corporation issued 14%,5-year bonds with a

Q165: On January 1, a company issues bonds

Q166: On January 1, a company issues bonds

Q169: On March 1,a company issues bonds with

Q194: On January 1, a company issued 10%,

Q211: _bonds have specific assets of the issuing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents