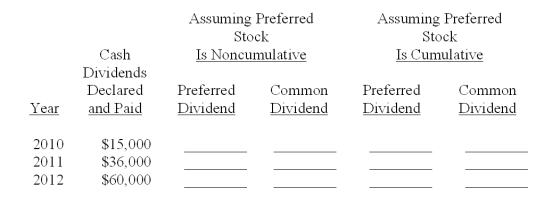

A company was organized in January 2010 and has 2,000 shares of $100 par value, 10%, nonparticipating preferred stock outstanding and 30,000 shares of $10 par value common stock outstanding. It has declared and paid cash dividends each year as shown below. Calculate the total dividends distributed to each class of stockholder under each of the assumptions given.

Correct Answer:

Verified

Q178: A company has $100,000 of 10% noncumulative,nonparticipating,preferred

Q192: For each of the following independent transactions

Q195: On July 31,a company declared a cash

Q198: On January 10,a corporation purchased 5,000 shares

Q206: Stock that is not assigned a value

Q212: A company is authorized to issue 750,000

Q215: A corporation has 200,000 shares of $10

Q216: A company reported stockholders' equity on January

Q220: A company reported the following stockholders' equity

Q221: _ has special rights that give it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents