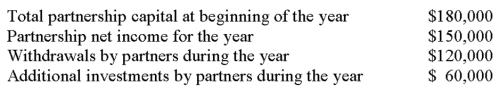

The following information is available on Stewart Enterprises, a partnership, for the most recent fiscal year:  There are three partners in Stewart Enterprises: Stewart, Tedder and Armstrong. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively. Compute the ending capital balances of the three partners.

There are three partners in Stewart Enterprises: Stewart, Tedder and Armstrong. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively. Compute the ending capital balances of the three partners.

A) Stewart = $108,000; Tedder = $54,000; Armstrong = $108,000.

B) Stewart = $90,000; Tedder = $90,000; Armstrong = $90,000.

C) Stewart = $204,000; Tedder = $102,000; Armstrong = $204,000.

D) Stewart = $84,000; Tedder = $102,000; Armstrong = $84,000.

E) Stewart = $60,000; Tedder = $30,000; Armstrong = $60,000.

Correct Answer:

Verified

Q63: A partner can withdraw from a partnership

Q64: Badger and Fox are forming a partnership.

Q66: When a partnership is liquidated:

A) Noncash assets

Q67: Smith, West, and Krug form a partnership.

Q68: Groh and Jackson are partners. Groh's capital

Q69: Badger and Fox are forming a partnership.

Q70: Smith, West, and Krug form a partnership.

Q74: A capital deficiency means that:

A) The partnership

Q77: Groh and Jackson are partners. Groh's capital

Q78: A bonus may be paid:

A) By a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents