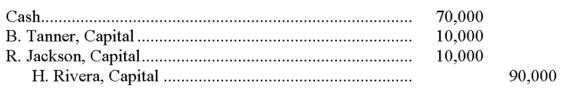

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

A) Acceptance of a new partner who invests $70,000 and receives a $20,000 bonus.

B) Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C) Addition of a partner who pays a bonus to each of the other partners.

D) Additional investment into the partnership by Tanner and Jackson.

E) Withdrawal of $10,000 each by Tanner and Jackson upon the admission of a new partner.

Correct Answer:

Verified

Q43: A partnership in which all partners have

Q52: Collins and Farina are forming a partnership.

Q53: Partners' withdrawals of assets are:

A) Credited to

Q55: Nguyen invested $100,000 and Hansen invested $200,000

Q60: Trump and Hawthorne have decided to form

Q63: A partner can withdraw from a partnership

Q68: Groh and Jackson are partners. Groh's capital

Q70: Smith, West, and Krug form a partnership.

Q74: A capital deficiency means that:

A) The partnership

Q78: A bonus may be paid:

A) By a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents