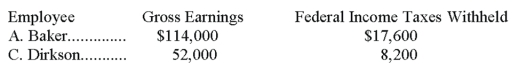

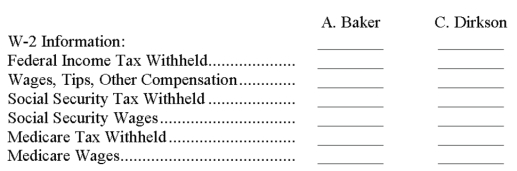

A company's employer payroll tax rates are 0.8% for federal unemployment taxes, 5.4% for state unemployment taxes, 6.2% for FICA social security taxes on earnings up to $106,800, and 1.45% for FICA Medicare taxes on all earnings. Compute the W-2 Wage and Tax Statement information required below for the following employees:

Correct Answer:

Verified

Q143: A company sells computers with a 6-month

Q144: Pastimes Co. offers its employees a bonus

Q154: Ember Co. entered into the following transactions

Q158: Arena Sports receives $31,680,000 cash in advance

Q162: Times interest earned is computed by dividing

Q177: A company's payroll information for the month

Q180: The payroll records of a company provided

Q190: Gross pay less all deductions is called

Q205: To compute the amount of tax withheld

Q206: Companies with many employees often use a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents