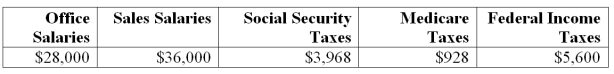

Frado Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for May.  a. Recorded the March payroll using the payroll register information given above.

a. Recorded the March payroll using the payroll register information given above.

b. Recorded the employer's payroll taxes resulting from the March payroll. The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee. Only $42,000 of the current months salaries are subject to unemployment taxes. The federal rate is .8%.

c. Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d. Issued a check to the state for the payment of the SUTA taxes for the month of May.

e. Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

Correct Answer:

Verified

Q123: Agro Depot's income before interest expense and

Q135: On September 15, SportsWorld borrowed $75,000 cash

Q137: Calco had income before interest expense and

Q147: On January 31, Hale Company's payroll register

Q151: All Star Sports receives $48,000,000 cash in

Q156: Blake Company pays its employees for two

Q157: The payroll records of a company provided

Q160: _ are obligations due within one year

Q163: Unearned revenues are amounts received _ for

Q195: Contingent liabilities are recorded in the accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents