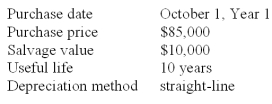

The following information is available on a depreciable asset owned by First Bank & Trust:  The asset's book value is $70,000 on October 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last three months of Year 3 would be:

The asset's book value is $70,000 on October 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last three months of Year 3 would be:

A) $2,187.50

B) $1,718.75

C) $2,031.25

D) $2,321.43

E) $1,964.29

Correct Answer:

Verified

Q14: The useful life of a plant asset

Q62: Lomax Enterprises purchased a depreciable asset for

Q63: Dart had net sales of $35,404 million.

Q65: Once the estimated depreciation expense for an

Q66: A machine originally had an estimated useful

Q68: Thomas Enterprises purchased a depreciable asset on

Q70: Total asset turnover is used to evaluate:

A)The

Q75: Lomax Enterprises purchased a depreciable asset for

Q75: Total asset turnover is calculated by dividing:

A)

Q79: When originally purchased,a vehicle had an estimated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents