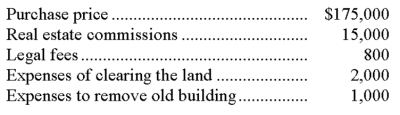

A company purchased property for a building site. The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $175,800 to Land; $18,800 to Building.

B) $190,000 to Land; $3,800 to Building.

C) $190,800 to Land; $1,000 to Building.

D) $192,800 to Land; $0 to Building.

E) $193,800 to Land; $0 to Building.

Correct Answer:

Verified

Q25: The total cost of an asset less

Q71: Land improvements are:

A) Assets that increase the

Q81: A company purchased a delivery van for

Q83: The formula for computing annual straight-line depreciation

Q86: A depreciation method in which a plant

Q90: A method that allocates an equal portion

Q92: Revenue expenditures:

A)Are additional costs of plant assets

Q93: Another name for a capital expenditure is:

A)

Q93: A method that charges the same amount

Q100: A company paid $150,000,plus a 6% commission

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents